How an Umbrella Insurance Policy Works

Chances are slim that you will lose a lawsuit for a sum greater than what your existing insurance will pay: But if you ever did find yourself in that situation, you could lose all your savings and other assets. A good umbrella policy can prevent that nightmare from happening.

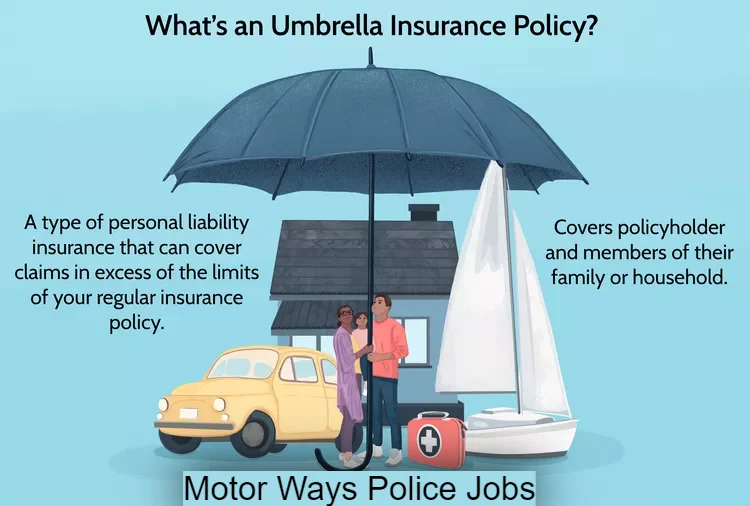

Umbrella insurance is a type of personal liability insurance that can cover claims in excess of the limits of your regular insurance policy. Below, we’ll take a closer look at this extra liability coverage: how an umbrella policy works, who needs it, how much it costs and what it won’t cover.

KEY TAKEAWAYS

- Umbrella insurance is a type of personal liability insurance that covers claims in excess of regular homeowners, auto, or watercraft policy coverage.

- Umbrella insurance covers not just the policyholder, but also other members of their family or household.

- Umbrella insurance covers injury to others or damage to their possessions.

- It doesn’t protect the policyholder’s property or liability due to injury or damage caused on purpose.

- Umbrella insurance is quite cheap compared to other types of insurance.

What Is Umbrella Insurance?

Umbrella insurance is a type of personal liability insurance that can be indispensable when you find yourself liable for a claim larger than your homeowner’s insurance or auto insurance will cover. If you own a boat, umbrella insurance will also pick up where your watercraft’s liability insurance leaves off.

Umbrella insurance also covers certain liability claims that those aforementioned policies may not, such as libel, slander, and false imprisonment. And if you own rental property, umbrella insurance provides liability coverage beyond what your renter’s policy covers.

How Does an Umbrella Policy Work?

- Here are some examples of incidents where an umbrella policy could provide financial coverage if your homeowner’s insurance or auto insurance isn’t enough:

- Your dog runs out of the house and viciously attacks a neighbor who was going for a walk. Your neighbor sues you to cover her medical bills, lost wages, and pain and suffering.

- Your daughter gets into a fight at school and punches another girl, breaking her nose. The girl’s parents sue you.

- You cause a 10-car accident and your auto insurance property damage coverage isn’t high enough to replace all 10 accident victims’ vehicles. Nor is your personal liability coverage high enough to pay for their medical bills.

- You send sandwiches to your son’s school for a field trip lunch. Several students develop food poisoning and their parents sue you.

- Your teenager throws a party at your house while you’re out of town. Someone brings alcohol to the party, and one of the guests is arrested for driving under the influence on the way home. You are sued.

As you might have gleaned from these examples, umbrella insurance covers not just the policyholder, but also other members of their family or household. So if your teenager isn’t the best driver, you can sleep better at night knowing your umbrella policy will cover the injured parties’ medical bills if your kid is found liable for a major accident. That being said, make sure you understand how your policy defines a household member so you’ll actually have the coverage you need.

You might have also noticed that, even though umbrella insurance acts as coverage above and beyond your homeowners and auto insurance, the incident doesn’t have to involve your property or your vehicle for your umbrella insurance to cover it. You’re also covered worldwide, with the exception of homes and cars you own under other countries’ laws.

Quick Reference for Umbrella (Personal Liability) Coverage

| Usually Covers |

Usually Does Not Cover |

| Claims beyond coverage provided by home, rental, auto, watercraft policies for injury/damage to people/property | Damage to policyholder’s own property (e.g., home, car, possessions) |

| Policyholder plus members of household | Damage/injury that policyholder causes intentionally or criminally |

| Malicious prosecution, wrongful entry, invasion of privacy | Damage/injury from or during business or professional activities |

| Libel, slander, false imprisonment | Liability assumed contractually |

| Attorney fees/other expenses related to lawsuits | Liability related to armed conflicts |

Do You Need Umbrella Insurance?

There’s certainly a fear factor involved in the decision to buy umbrella insurance. Many insurance companies say you need it because of the lawsuit-happy world we live in, where anyone can sue you for anything and ruin you financially.

You can find plenty of personal liability horror stories in the news, where juries awarded multimillion-dollar judgments to the victims that individuals had to pay. But how likely are you to find yourself in such a situation? Do you really need umbrella insurance?

Extra Coverage That Protects Your Assets

You might hear that you should purchase umbrella insurance if the total value of your assets, including ordinary checking and savings accounts, retirement and college savings and investment accounts, and home equity is greater than the limits of your auto or homeowner’s liability. The idea behind this advice is that you want to have enough liability insurance to fully cover your assets so that you can’t lose them in a lawsuit.

However, jury awards can easily exceed insurance policy limits. The real question you should ask yourself is, am I at risk of being sued? Everyone is, so in a sense, umbrella insurance makes sense for everyone. It’s a small price to pay for the extra peace of mind.

Option for Those With High Risk Potential

Some people are more likely to need an umbrella policy than others. If you engage in some activity that puts you at greater risk of incurring excess liability, then you’re a good candidate for an umbrella policy. Personal liability risk factors include owning property, renting it out, employing household staff, having a trampoline or hot tub, hosting large parties, and being a well-known public figure.

Having a teenage driver in the family also puts you at increased risk, as does owning a dog or owning a home with a swimming pool. Basically, the more likely you are to be sued, the more strongly you should consider purchasing umbrella insurance. But anyone who is risk-averse will sleep better at night knowing they’re protected by an umbrella policy.

Example of How Umbrella Insurance Works

- Let’s say that your homeowner’s insurance has a personal liability limit of $300,000. You throw a large holiday party, and one of your guests slips and falls on your icy front steps. She ends up with a concussion and some astronomical medical bills and decides to sue you. In court, the jury sides with your party guest and awards her a judgment of $1 million. This judgment is $700,000 higher than your homeowner’s insurance liability limit.

- Without a personal liability umbrella, you have to pay that $700,000 out of pocket. The money will have to come out of your retirement account, your main source of savings. The loss is devastating and means you’ll have to work 10 additional years, find a higher paying job, or drastically cut back your expenses to replenish your savings and get back on track to be able to retire.

- But if you have $1 million in umbrella insurance, your umbrella policy will cover the portion of the judgment that your homeowner’s insurance doesn’t, and your retirement savings will remain intact. The umbrella policy will also cover any attorney fees and other expenses related to the lawsuit that weren’t covered by your homeowner’s policy. That coverage is in addition to the $1 million.

- If you have a $5,000 deductible on your homeowner’s insurance, you’ll pay that amount out-of-pocket. Then, your homeowner’s policy will pay the next $295,000, which gets you to the $300,000 policy limit. Your umbrella insurance doesn’t have a separate deductible in this case, because the homeowner’s policy covered part of the loss. Your umbrella policy pays the remaining $700,000 of the judgment plus legal expenses, so you’re only out-of-pocket $5,000 for the $1 million judgment.

- What if you were found liable in a case where your homeowner’s or auto insurance didn’t apply? Then you’d pay an umbrella insurance deductible, called self-insured retention, before the umbrella policy kicked in.

How Much Does Umbrella Insurance Cost?

The cost of an umbrella liability policy depends on how much coverage you purchase, the state where you live (insurance rates vary by state) and the risk that insuring you presents to the insurance company. The more homes or cars you own, and the more household members your policy must cover, the more it will cost.

The Insurance Information Institute says that most $1 million policies cost $150 to $300 per year. You can expect to pay about $75 more per year for $2 million in coverage, and another $50 per year for every extra $1 million in coverage beyond that. Most insurance companies’ umbrella liability policies start at $1 million in coverage, with higher limits available.

Umbrella Insurance Is Inexpensive Compared to Other Insurance

Umbrella insurance is quite cheap compared to other types of insurance, especially considering how much coverage it provides. That’s because you have to carry plenty of homeowner’s and auto insurance before an insurance company will issue you an umbrella policy. In fact, you’ll probably have to carry the maximum liability coverage available under these policies before you can purchase an umbrella policy.

Most people already have at least $100,000 in homeowner’s coverage. Minimum auto insurance liability coverage depends on your state’s laws but typically runs $25,000 per person and $50,000 per accident. The maximum you can usually purchase is $500,000 in personal liability under your homeowner’s policy and $250,000 per person and $500,000 per accident under your auto insurance policy.

If you don’t already have this much coverage, your homeowner’s and auto insurance premiums will go up, making the umbrella policy more expensive than it might seem at first glance.

Purchasing Umbrella Insurance

If increasing your coverage and purchasing an umbrella policy is too expensive for you, as an alternative, you may be able to purchase endorsements to your auto or homeowners insurance that increase your liability limits beyond the usual maximums. You probably won’t get as much coverage as an umbrella policy could provide, but you’ll still be better protected than you were before.

Another possible requirement for getting umbrella insurance is that you have your auto or homeowner’s insurance with the same company that issues your umbrella policy. But even if the umbrella insurer you choose does not require this, you might get the insurer’s bundling discount if you do so. Also, it might be easier to have all your policies with the same company for administrative reasons.

Then again, switching insurers to have all your policies under one roof might mean higher premiums overall, if the new company’s rates are higher. So you’ll want to compare quotes carefully.

What Doesn’t Umbrella Insurance Cover?

One great thing about umbrella policies is that they provide broad coverage. They cover any incident that the policy does not specifically exclude, unlike some insurance policies, which only cover specifically named incidents. But no insurance policy covers everything. Here are some things your umbrella policy likely won’t cover:

Damage to your own property. Remember, it’s a liability policy, so it will only cover you if you’re held responsible for damage to someone else’s property. Make sure you have enough homeowner’s insurance to protect your own property and possessions.

Damage that you or a covered member of your household cause on purpose. If you deliberately pushed your party guest down the stairs, umbrella insurance wouldn’t cover the costs of the lawsuit or judgment (and neither would your homeowner’s insurance).

Liability incurred in business or professional activities. You’ll need business liability insurance to cover these incidents.

Liability you agreed to assume under a contract you signed

Liability related to war or armed conflicts. Good luck finding any type of insurance that covers war-related damage; the financial losses associated with war are too high for insurance companies to cover.

Is Umbrella Insurance a Good Idea?

It could be if you seek greater peace of mind over the possibility of a financial liability that could deplete your financial assets and you don’t mind the added cost.

Is Umbrella Insurance Expensive?

Not usually, relatively speaking. For example, a $1 million policy might cost anywhere from $150 to $300 annually. Bear in mind that it covers liability beyond what other policies that you have (homeowners and auto, for example) will cover. Typically, those will need to be at maximum coverage levels before you’re issued an umbrella insurance policy.

Where Can I Buy Umbrella Insurance?

You can probably purchase it from the same insurance company that covers your home and auto. You may also be able to buy it from a different insurance company. Be sure to request quotes so that you can consider the most affordable options.